Why did we create a better solution to impact investing?

Many investors who put their money in the hands of traditional investment managers that promote “Environmental, Social, Governance (ESG)” and “socially responsible investing” have good intentions – but the reality is, they may actually be investing in ways that inadvertently cause social, economic, and environmental harm.

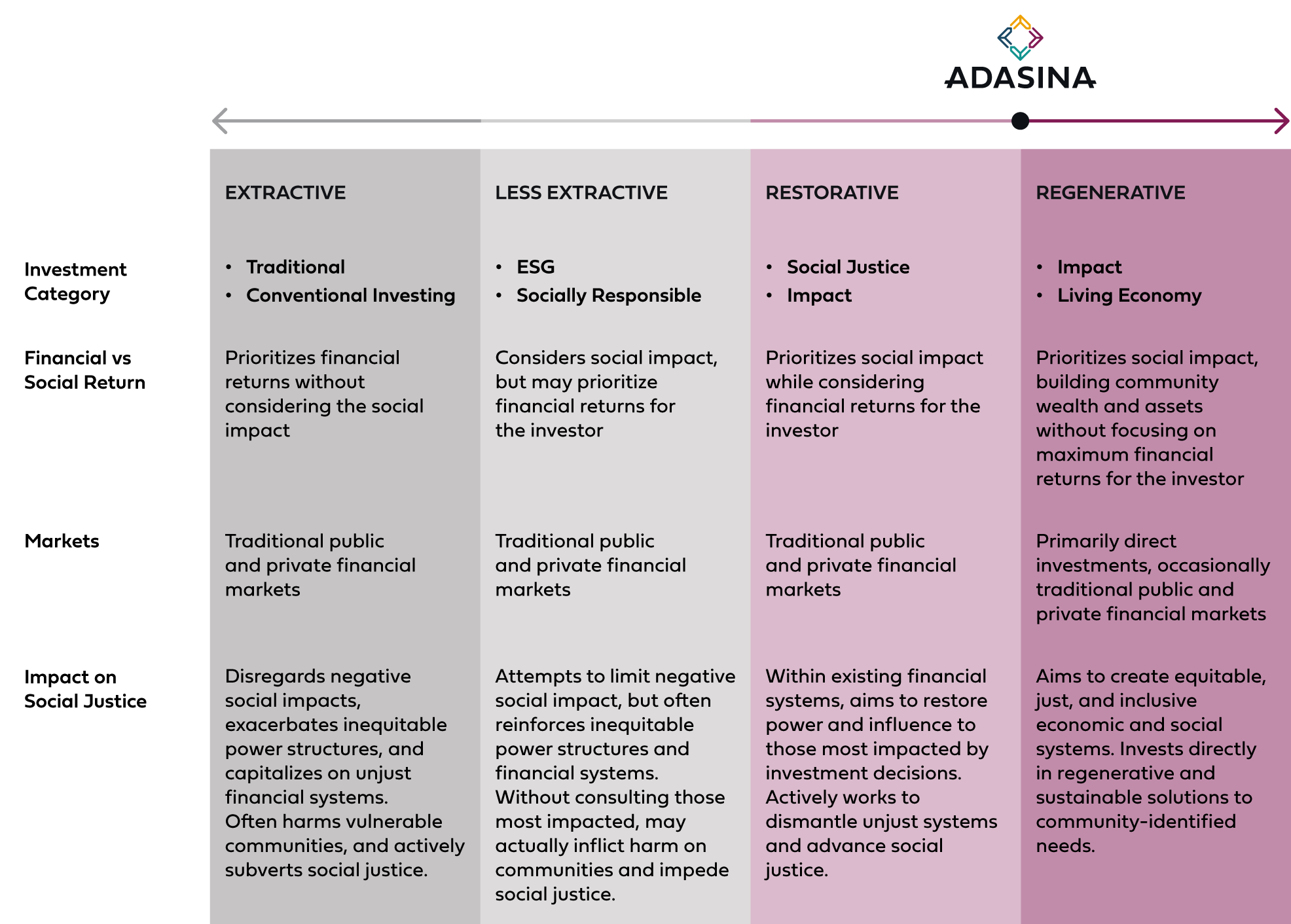

We occupy a unique place in the financial industry, offering both restorative and regenerative investment solutions that center the goals of social justice movements in our approach.

Extractive to Regenerative Investment Spectrum

*The Extractive to Regenerative Spectrum was originally introduced by Justice Funders as a guide for social justice focused philanthropy. It has been adapted here for the investment industry.

The Adasina Social Justice Investment Criteria:

Together with social justice organizations, we developed the Adasina Social Justice Investment Criteria– a data-driven set of standards that guides our investment strategies to reflect social justice values and advance progressive movements for change.

These datasets determine where to “draw the line” so that public companies and governments can choose which side of justice they stand on. This informs our investment decisions. We further leverage this community-sourced data to educate and organize the investment industry to effect positive, systemic change for people and the planet.

These criteria focus on four intersectional issue areas:

Our Racial Justice criteria aim to uproot systems that reinforce, perpetuate, and exacerbate racial inequities. We evaluate companies to determine whether they participate in, or benefit from, those unjust systems.

Our investment criteria include:

- Prison Involvement

- Prison Funding

- Prison Labor

- Money Bail Involvement

- Immigrant Detention

- Citizen & Immigrant Surveillance

- Occupied Territories

- Indigenous Peoples' Rights

- Diversity & Inclusion Policies

- For-Profit Colleges

- Civil & Voting Rights

Our Gender Justice criteria aim to ensure safe and fair opportunities for all people, regardless of their gender identity. We evaluate companies to determine whether their policies and practices support gender equity and LGBTQ+ equality.

Our investment criteria include:

- Sexual Harassment

- Reproductive Rights

- Board Representation

- LGBTQ Equal Employment Opportunity

Our Economic Justice criteria aim to create a fair and equitable financial future for all people and communities. We evaluate companies to determine whether they deal fairly with the public and their employees.

Our investment criteria include:

- Subminimum Wages for Employees

- Forced Labor & Child Labor

- Worker Protections & Rights

- Working Conditions

- Excessive Executive Pay

- Predatory Lending

Our Climate Justice criteria aims to advance the goals of environmental sustainability in partnership with social justice movements. We evaluate companies to determine whether they significantly contribute to climate change, lack environmentally sustainable practices, or negatively impact air and water quality.

Our investment criteria include:

Invest With Us

Public Equities Strategy

- Stocks -

Integrate our social justice investing approach for public equities into your existing investment portfolio.

Learn More.

Public Equities Strategy (Stocks)

Our public equities strategy uses the Adasina Social Justice Investment Criteria to build a portfolio of stocks that reflects social justice values and advances progressive movements for change.

Available investment solutions:

- Adasina Social Justice All Cap Global ETF (Exchange-Traded Fund)

Visit the ETF website to learn more. - Adasina Social Justice Index

The Adasina Social Justice All Cap Global ETF tracks the Adasina Social Justice Index, a global universe of public equities across all major asset classes screened for social justice. We created the Adasina Social Justice Index to serve both as a suitable benchmark for our own Public Equities Strategy and as a standard for all stock portfolios that seek to advance social justice. The Index was created in collaboration with EQM Indexes and Your Stake.

Visit the Index website to learn more. - Adasina Social Justice Separately Managed Accounts

Adasina Social Capital offers a US All Cap, SMA through Parametric with a $250,000 minimum, and offers a US Large Cap SMA via Natixis with a $100,000 minimum.